Australia’s leaders would like Australia to be a green energy superpower. The delivery of green energy has multiple dimensions, with the manufacture of windmills or wind turbines being prominent in the discussion.

Some commentators suggest Australia should exploit its competitive advantages by making complete windmills. However, many countries have similar or weaker competitive advantages and have already applied them to wind turbine manufacturing.

In a strategic sense, they have created and leveraged their distinctive capabilities. For example, the global leader Danish company Vestas Wind Systems, with revenues of A$24.9 billion, has been designing, making, installing, and servicing wind turbines since 1945.

Spanish SGRE (Siemens Gamesa Renewable Energy) has been in the market since 1976, German Nordex ($10.7 billion) since 1985 and US GE Renewable Energy ($48.9 billion) since 2015.

The current top 15 global manufacturers include 10 Chinese companies, including Goldwind ($10.4 billion), established in 1998; Windley ($3.9 billion), established in 2001; and Sany ($3.1 billion), set up in 2008.

It is unlikely that a new Australian company would reach this global scale in the short term and be able to compete effectively. An alternative is to enter the market based on a distinctive capability.

A distinctive capability is a superior characteristic, strength, or quality that distinguishes a company from its competitors. This distinctive quality can be just about anything – innovation, a skill, a design, a technology, a brand, a marketing approach, leadership talent, workforce culture, customer satisfaction, and being first to market.

Unlike the economist’s notion of competitive advantage, distinctive capabilities can be created through plans, strategies, and disciplined implementation.

Distinctive capabilities to build wind turbines

Wind turbine manufacturing involves an integrated supply chain with components sourced from around the world. While some countries have vertically integrated manufacturing processes, others rely on a network of suppliers from different countries to provide components and subsystems.

Rather than making the whole turbine, Australia may wish to be integrated into these ecosystems using its distinctive capabilities.

Several Australian automotive companies, including GUD, ARB, and PWR, are doing well in the global automotive industry ecosystem by manufacturing components.

So, if Australia can’t manufacture the whole windmill, at least in the shorter term, which parts should it focus on?

Components in a windmill

Wind turbines are highly engineered machines that require diverse components to function reliably and efficiently. A typical modern windmill consists of hundreds, even thousands, of individual components, each serving a specific function in generating electricity from wind energy.

The number of components can vary depending on the turbine’s specific design, size, and manufacturer. A generalised breakdown of component categories includes:

- Tower components: foundation, tower sections, ladder, platforms, lightning protection system

- Nacelle components: generator, gearbox, rotor hub, yaw drive system, yaw motor, yaw bearings, brake system, cooling system, electrical system

- Rotor components: rotor blades, blade root attachments, pitch system, blade bearings

- Drive train components: main shaft, low-speed shaft, high-speed shaft, bearings, couplings

- Control system components: sensors, controllers, data acquisition systems, communication systems

- Electrical components: cables, connectors, transformers, switchgear, power electronics, control panels

- Support structures: base frame, bedplate, nacelle frame, yaw bearing housing, bearing blocks

- Foundation components: anchor bolts, concrete foundation, rebar, and grouting materials

- Access components: service crane, service platforms, access doors, safety systems

- Environmental components: vibration dampers, noise reduction measures, and ice prevention systems.

Which part does Australia want to make?

In any manufacturing industry, value creation differs across different stages of the production process.

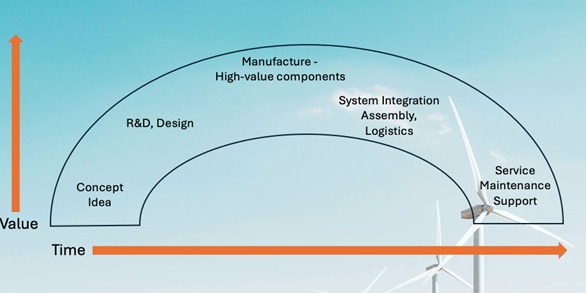

This is typically represented as a continuum, with the left representing upstream activities such as research, development, and design and the right representing downstream activities such as assembly, distribution, and sales.

The continuum is sometimes represented as a curve or an archway, with a peak representing the highest value-adding stages.

In wind turbine manufacturing, the components that typically create the most value are those that involve higher levels of technology, innovation, and intellectual property. They also require specialised expertise.

At the beginning of the archway, significant value is created through research, development, and design activities. This includes the development of innovative technologies, materials, and manufacturing processes that improve the performance, efficiency, and reliability of wind turbines.

The peak of the curve represents the manufacturing of high-value components that require specialised expertise, precision engineering, and advanced manufacturing processes. These include components such as rotor blades, generators, and power electronics that tend to create significant value due to their complexity, performance requirements, and strategic importance.

Companies that excel in manufacturing these critical components can differentiate themselves through quality, reliability, and innovation, capturing value through proprietary technology and market leadership.

As the curve descends towards the right side, value creation shifts towards system integration, assembly, and logistics. This includes assembling individual components into complete wind turbines and installing, commissioning, and maintaining wind farms.

While these activities are essential for delivering finished products to customers and ensuring operational performance, they generally contribute less value than upstream activities.

The tail end of the curve represents after-sales services, maintenance, and customer support. While these activities are crucial for ensuring wind turbines’ long-term performance and reliability, they typically generate lower margins than upstream activities and component manufacturing.

Ideally, Australia should seek to position itself at the peak of the archway, with strong connections to R&D and System Integration components.

Australia’s distinctive capabilities

While Australia is not yet a major player in the global wind turbine manufacturing industry, several distinctive capabilities could enable the country to develop a competitive edge:

- A strong R&D sector focused on advanced materials, including composites, polymers, and metals. These are critical components in rotor blades, hubs, and towers. Collaborations between research institutions, industry partners, and government agencies could lead to innovations in lightweight, durable materials tailored for wind turbine applications in an Australian environment

- A knowledgeable and skilled workforce with expertise in engineering disciplines relevant to wind turbine design and manufacturing. Universities and technical institutes offer courses in mechanical engineering, renewable energy systems, and aerospace engineering programs, providing a talent pool capable of contributing to wind turbine technology development

- An emerging advanced manufacturing sector with expertise in precision engineering, fabrication, and assembly processes. By leveraging existing metalworking, machining, and component manufacturing capabilities, Australian companies could integrate into the global supply chain for wind turbine components, focusing on specialised or high-value-added products

- A developing framework of support through government incentives, research grants, and industry partnerships. The Australian Renewable Energy Agency (ARENA) and the Clean Energy Innovation Fund.

However, these distinctive capabilities may be insufficient to carve out a niche position in the global energy superpower league.

How distinctive capabilities can be created

Innovation often comes from foresight, including finding parallels in similar but often different industry sectors.

For example, Australia excels at high-performance yacht racing, including offshore ocean racing, Americas Cup yachts, and SailGP competitions. These expensive pursuits offer unique insights and innovations that can be specifically applied to the design and construction of wind turbines. Parallels cluster around several technologies.

- Aerodynamic Efficiency: Yacht designers focus on minimising aerodynamic drag and maximising lift to optimise speed and performance in varying wind conditions. Insights could assist wind turbine designers in optimising blade design, reducing aerodynamic losses, and increasing energy capture from the wind. This could also include ways to adjust the shape of the blade as wind conditions change (as sailors can do with rigid Kevlar sails)

Offshore racing yachts are meticulously designed to minimise hydrodynamic drag and maximise speed through the water. Foiling yachts, such as those used in the America’s Cup and SailGP, utilise hydrofoils to lift the hull out of the water, reducing drag and enabling higher speeds.

Wind turbine designers could apply similar principles to minimise hydrodynamic drag on offshore turbine platforms and support structures, reducing energy losses and increasing efficiency in challenging marine environments.

- Hydrodynamics and Fluid Mechanics: Yacht designers study hydrodynamic principles to minimise water resistance and maximise hull efficiency, resulting in smoother sailing and improved performance. Wind turbine engineers could apply fluid mechanics principles to optimise the aerodynamic performance of turbine components where there is wet weather to reduce turbulence and enhance energy conversion efficiency

- Materials and Construction: Offshore racing yachts require exceptional structural integrity and stability on their spars and hulls to withstand the powerful forces of wind and waves encountered during ocean racing. Wind turbine engineers could learn from yacht designers’ approaches to structural optimisation, fatigue analysis, and stability control to enhance the resilience and reliability of offshore wind turbine structures and ensure long-term performance and safety

- High-performance racing yachts also incorporate advanced composite materials, such as carbon fibre, Kevlar, fibreglass and epoxy resins, to achieve lightweight yet strong hulls, sails, winches, and many other components. Wind turbine manufacturers could leverage similar materials and construction techniques to develop lightweight yet robust turbine blades, towers, and nacelles, improving performance and durability in harsh conditions

- Control Systems and Automation: High-performance yachts use advanced control systems and sensors to adjust sail trim, foil position, and hull attitude for maximum performance and maintain stability in changing wind and sea conditions. Similar technologies could benefit wind turbine control systems, enabling real-time adjustments to blade pitch, yaw orientation, and rotor speed to maximise energy capture and minimise structural loads.

This is only one foresight example. However, by drawing specific lessons and innovations from another industry, wind turbine manufacturers can harness the latest advancements in hydrodynamics, materials science, structural engineering, and control systems to optimise offshore wind energy systems’ performance, reliability, and sustainability.

Becoming a partner with global turbine manufacturers

First and foremost, a comprehensive and ambitious strategy would be required to ensure Australia creates, promotes and utilises its distinctive capabilities in the wind turbine manufacturing ecosystem. This would require:

- Further R&D investment focused on areas such as aerodynamics, materials science, control systems, manufacturing processes, and wind turbine technology.

- Creation of dedicated research centres, innovation hubs, and collaborative networks to drive breakthroughs in wind energy technology and foster cross-disciplinary collaboration.

- Investment in education and training programs to develop a skilled workforce capable of designing, manufacturing, and operating wind turbines and related infrastructure.

- Fostering collaboration between government, industry, and research organisations to drive technology transfer, knowledge sharing, and innovation.

- Support the growth of a domestic supply chain for wind turbine components and subsystems, including blades, towers, drivetrains, and control systems.

- Foster partnerships with global players through DFAT and Austrade and explore opportunities for technology transfer, licensing agreements, and joint ventures.

- Invest in research and development of next-generation wind turbine technologies, including floating offshore wind, hybrid renewable energy systems, and advanced materials for increased efficiency and reliability.

- Promote transparency, accountability, and good governance in wind energy development, fostering trust and collaboration with local communities and Indigenous stakeholders.

Australia’s place in the global wind turbine manufacturing ecosystem will, in the first instance, rely on developing its distinctive capabilities based on what it is currently good at and creating new areas of distinctiveness where there are clear gaps and opportunities.

Dr John H Howard is a Visiting Professor at the University of Technology Sydney and Executive Director at the Acton Institute for Policy Research and Innovation www.actoninstutite.au. He can be contacted at john@actoninstitute.au

Do you know more? Contact James Riley via Email.