The FTX fraud and the collapse of Silicon Valley Bank highlight just how unstable the finance system can be.

Ever since bankers learnt that they could make money from lending depositors’ money to someone else rather than just keeping it in the safe (so to speak), the risk of a bank not being able to respond to a depositor’s request to withdraw their money has created risk. Similarly, people making equity investments rely upon the company’s management to report their activities truthfully.

These risks to the general community result in a political decision to implement regulation of these institutions. In the case of banks, regulators imposed limits on capital adequacy and liquidity. Capital adequacy is a measure of how much of the money lent by the bank (its assets) is shareholders’ equity (capital) versus depositors’ money (or money borrowed from other institutions). Liquidity is a simpler concept and refers to just how much cash the bank holds against potential demands on that cash.

The problem with this kind of regulation is that it creates “moral hazard”. This concept, derived from the insurance industry, means that the presence of the regulation can induce more risky behaviour.

Let’s take the case of Silicon Valley Bank (SVB). Its problems stemmed from a decision to invest heavily in long-dated government bonds. These assets are regarded as low risk; consequently, the bank has to hold very little capital for them. So holding government bonds doesn’t seem like risky behaviour, and it isn’t so long as you can keep the bonds to maturity.

When interest rates rise, you suddenly confront an increased risk. An investor can get a better return on a new bond rather than buying your long-dated bond from you. The risk only materialises if you need to sell the assets.

This risk creates a perverse incentive for the bank. You don’t want to acknowledge the increased risk because that might create a run on deposits which manifests the risk. However, if you don’t acknowledge the risk, you are at risk of perpetuating the behaviour.

Everything is okay until you reach the point where a third-party (typically a rating agency) reviews your books and announces the risk. It is more of a shock if the rating agency makes the announcement because depositors worry that management isn’t competent.

The logic is very straightforward to this point. The collapse of SVB was not inevitable just because of the change in interest rates. It was triggered because a high rate of withdrawals had already required the liquidation of some of these bonds. The bank sought to raise additional capital after realising the losses, while the better strategy was to raise additional capital instead of realising the losses.

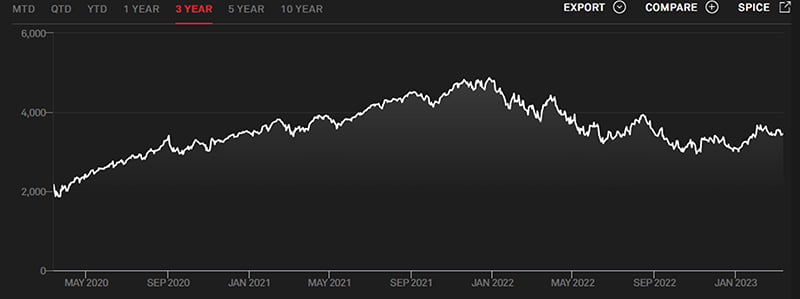

The question is why depositors were withdrawing their money. Firstly, SVB relied heavily on corporate deposits instead of retail, rapidly exposing it to increased withdrawals. Secondly, life has not been good for tech stocks throughout 2022. The three charts below are the NASDAQ 100 Technology Sector Index, Dow Jones U.S. Technology Index and the IG US Tech 100 chart (the latter over five years, the first two over three). As a generalisation, these markets would result in tech firms running down cash holdings because it wasn’t a good environment to raise additional capital or was a good time to buy back equity.

Interestingly, there is no evidence of a persistent discontinuity caused by the failure of FTX; however, that resulted in $32 billion in tech assets notionally disappearing overnight. It is possible that this perturbation flowed through to trigger further withdrawals.

SVB seemed like a straightforward proposition. A bank that tech firms could keep deposits in with a seemingly reliable investment policy of buying government bonds. Ultimately, it was a highly risky strategy that could be modelled and for which there was abundant evidence of the potential realisation of the risk.

Regulatory practice would mask this risk. The formula for capital adequacy is not sensitive to changes in market conditions that create substantial changes in asset risk, in this case, long-dated government bonds. The formulae also don’t measure potential mismatch between the term on assets and liabilities. Retail banks selling housing mortgages consciously secure term deposits to ensure against a sudden drawdown of deposits they can’t respond to by finding alternative funds or readjusting assets.

Here we see an eerie similarity with the events that triggered what we call the Global Financial Crisis (GFC) in Australia. In that case, banks did not fully understand the risk profile of the synthetic assets they were buying. Both instances reflect Boards and management in financial institutions not understanding the nature of the risks they were taking.

A focus of FinTech on innovative transactional approaches exacerbates these problems. In addition, the increasingly complex structure of any deposit-taking institution makes what used to be the daily task of the Assets and Liabilities Committee (ALCO) of managing this risk increasingly difficult.

FinTech could be the solution to this problem. The ability to work with big data means the risk profile can be recalculated from individual assets and liabilities (rather than categories) frequently. It also means that management can better model the consequences of uncertain environmental factors. As a result, Boards and management, represented by their ALCO, should be in a better position rather than a worse position to manage risk.

But that requires Boards to recognise, just as with cybersecurity, that it is their responsibility to manage risk exposure, not just to develop a compliance program against external standards. Unfortunately, regulation has the opposite effect. No depositor in SVB will lose their funds; no director will be disbarred.

David Havyatt is a former telco executive, former adviser to Federal Labor ministers and former advocate on behalf of energy consumers. He is a long term observer of Australian innovation policy.

Do you know more? Contact James Riley via Email.