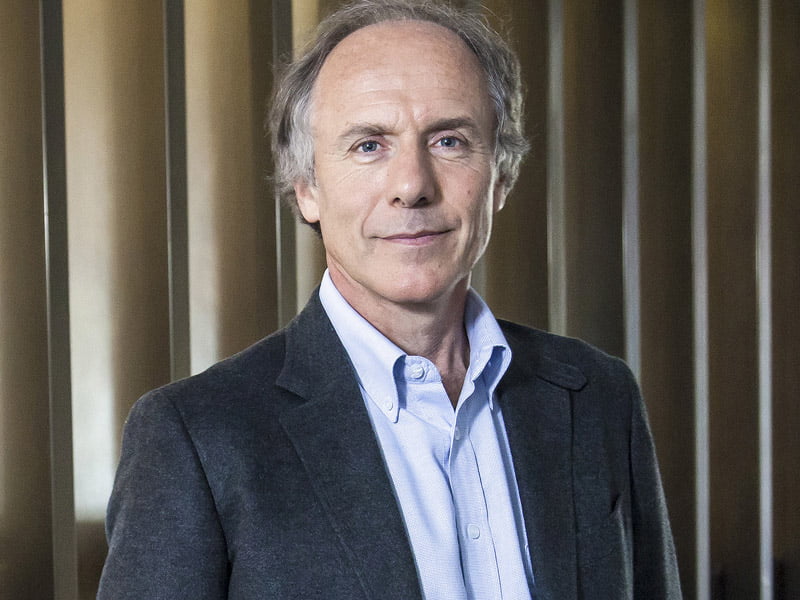

The national Hydrogen Strategy should be refreshed to increase support for a value-added hydrogen sector, according to former chief scientist Alan Finkel, who led the development of the existing strategy released three years ago.

Dr Finkel told the inaugural Australian Hydrogen Research Conference on Wednesday that overseas hydrogen production incentives, such as the $369 billion the United States Inflation Reduction Act, had made it difficult for Australia to be a commodity only supplier.

“We can’t match these international subsidies on an absolute dollar basis, so we have to be smart. Instead of aiming to be a commodity supplier of hydrogen, in my opinion, we should aim to be an added value supplier,” he said.

Dr Finkel, who is currently special advisor to the government on low emissions technology, suggested that it is “perhaps time” to update the National Hydrogen Strategy to support the development of a value-added hydrogen industry.

He said an updated hydrogen strategy should include a focus on “the use it where you make it philosophy” to increase the use of Australian green hydrogen in local value-added products.

The updated strategy should also include new funding, clearly address the role of hydrogen for heating, cooking and hot water, give greater consideration to the domestic distribution of hydrogen, and reiterate the importance of a hydrogen certification scheme.

A focus on value-added production moves the hydrogen conversation away from a sole focus on production and towards utilisation. Dr Finkel noted that green hydrogen production faces intense international competition, and is an identical commodity wherever it is produced.

As such the Australian industry needs to focus on a “supply and demand equation with an expression on both sides of the equal sign”.

“As I’ve surveyed progress in Australia since the adoption of the national hydrogen strategy, I see an enormous number of projects in planning but most of them are focused on production rather than utilisation.”

Hydrogen projects have soaked up the most investment across the Australian resources and energy development pipeline. It represents an estimated range of $230 billion to $303 billion of the total investment pipeline, estimated to be in the range $572 billion to $705 billion total.

According to Dr Finkel, value-added products from hydrogen are split into two categories. The first is for decarbonised products, which use hydrogen as an essential feedstock, while the second is for energy molecules.

“Green iron is a perfect example” of a decarbonised product that makes economic sense to process locally, Dr Finkel said.

Australian iron ore and coal, used to extract the iron, is currently shipped abroad at low cost for processing at blast furnaces in steel making countries. Dr Finkel argues that if steelmakers seek to decarbonise their products using green hydrogen, the same model of shipping feedstock to steelmaking countries will not be cost effective.

This presents an opportunity for Australian firms to process iron ore domestically before the green iron product is shipped

“There’s confidence everywhere I look, that even without subsidies, renewable hydrogen production will eventually achieve the incredibly low price of US$1 per kilogram. It won’t be this year, it won’t be this decade. It could be sometime in the next decade or the 2040s,” he said.

“People have a lot of confidence that it will be achieved, but shipping is difficult. I’m not seeing anyone forecast that it will fall below about $2 per kilogram for shipping.”

With regard to energy molecules, Dr Finkel noted that while low emissions intensity or renewable hydrogen will play an important role in local decarbonisation and for exporting to Asia, international competition is fierce.

As such, he threw support behind developing value-added fuels that build on Australia’s comparative advantage of land availability and potential for renewable energy generation.

“There is considerable interest in using renewable jet fuel made from hydrogen treated biomass feedstock where the process is much more efficient and the end product far superior than conventional biofuels,” Dr Finkel said.

“But even more exciting is the ultimate synthetic jet fuel..all it needs are two elements, carbon and hydrogen. Carbon can be extracted from the air using direct air removal and the hydrogen can be extracted from water…The end product is normally referred to as synthetic jet fuel.”

Before closing his address, Dr Finkel encouraged researchers to lend their support to Australia’s hydrogen industry.

“We are in the early days of the clean energy revolution and investments across the board are huge, so a sense of urgency in all that we do including the hydrogen sector is important,” he said.

“We need to think big. Ask yourself, can you align your research with any of the hydrogen moonshots? Can your research add value to Australian industry?”

When asked by InnovationAus.com whether the federal government should bolster support for blue hydrogen developments, Dr Finkel was ambivalent. He added that he is currently interested in renewable hydrogen because it can be scaled.

He previously spent time in an address to the Australian Hydrogen Conference in May 2022 interrogating emissions studies against blue hydrogen.

Dr Finkel is also chair of the government’s Technology Investment Advisory Council and sits on the Global Advisory Council of electrolyser firm Hysata. On Tuesday, he was also announced as a member of Victoria’s Expert Advisory Panel for the State Electricity Commission.

Do you know more? Contact James Riley via Email.

It is possible to break the 37kWhr/kg barrier by making using of energy already in the environment eg EM & IR.

How low can it go? Far lower than the US$1/kg. This is already in the lab.

Scale-up of electrolysis is also limited by capex.

We used expensive catalysts for PEMs. Its easy to see just how the PEM price could be halved.

The price of batteries will determine what price is paid for the power supply to a PEM. if you are going to use solar as the power source then you will need batteries. Those batteries can be directly connected to the PEMs.

Bus bars connecting the batteries will be directly connected by graphene coated copper to the PEMs. It will look like a 30A wire not a 50mm bus bar. It can be several kilometers from the battery farm.

Funding must support a well thought out plan. No plan exists.

The concern with Finkel’s strategy is in its current form the cost of “green” hydrogen and its use in value added “green” products is neither affordable or sustainable…unless he has a magic wand that he will wave between now and 2040 or 2050?

Perhaps he can identify those organisations that will purchase the products manufactured using “green” hydrogen and are will to pay super premiums? Surely it will not be shareholders or Superfund members or taxpayers?

If Finkel is incorrect what is his accountability?

Hear hear Dr Finkel. Let’s get Australia out of the rut of being an unsophisticated commodities provider. Proposing to replace x PJ of LNG and coal exports with the same x PJ of hydrogen were never going to work and would exacerbate the current lack of economic diversification we see in Australia. Now for business to follow through and let’s not hear the tired arguments that we are paying people too much and / or are too far from markets to be competitive.